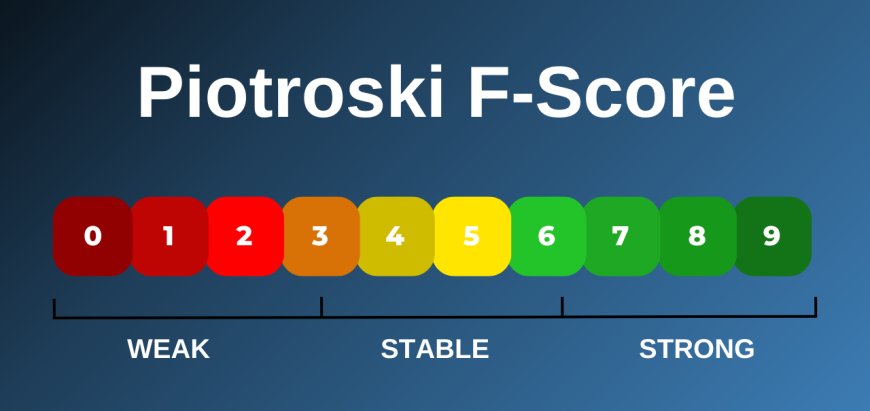

Piotroski's F-Score

The Piotroski's F- score is a score between 0-9 (with nine being the best and zero the worst) which reflects nine criteria used to determine the strength of a firm's financial position.

For every criteria that is met the company is given one point, if it is not met then no points are awarded. The points are then added up to determine companies with the strongest financial position. These nine ratios are explained in greater detail as follows:

Profitability

- Return on assets is positive (1 point). This criterion screens out loss making companies.

- Positive operating cash flow in the current year (1 point). This criterion filters out companies that rely on their own cash reserves or outside debt finance.

- Higher return on assets (ROA) in the current period compared to the ROA in the previous year (1 point). This criterion filters out companies where asset growth is outstripping profit growth.

- Cash flow from operations is greater than net income (1 point). This criterion attempts to filter out companies that may be engaging in profit manipulation.

Leverage, Liquidity and Source of Funds

- Lower ratio of long term debt to in the current period compared value in the previous year (1 point). This criterion intends to filter out companies that are taking on debt to finance operations because of shortfalls in free cash flow.

- Higher current ratio this year compared to the previous year (1 point). This criterion attempts to weed out companies that have decreasing working capital efficiency.

- No new shares were issued in the last year (1 point). This criterion weeds out companies reliant to dilutive equity issuance.

Operating Efficiency

- A higher gross margin compared to the previous year (1 point). This criterion intends to weed out companies that may be coming under pricing pressure from competitors.

- A higher asset turnover ratio compared to the previous year (1 point). This criterion tries to weed out companies that have declining asset efficiency.

If a company scores 8 or 9, it is considered to have strong and improving financials, whereas a score between 0-2 points suggests a company has weak and deteriorating financials.

What's Your Reaction?